Schedule 14A

(Rule 14a-101)

INFORMATION REQUIRED IN CONSENT SOLICITATION STATEMENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Consent solicitation statement

(Rule 14a-101)

Amendment 1

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantx |

| Filed by a Party other than the Registranto |

|

Check the appropriate box: |

| x | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

| PAID, INC. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

| x | No fee required |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

PAID, INC.

200 Friberg Parkway, Suite 4004

Westborough, Massachusetts 01581

(617) 861-6050

___________

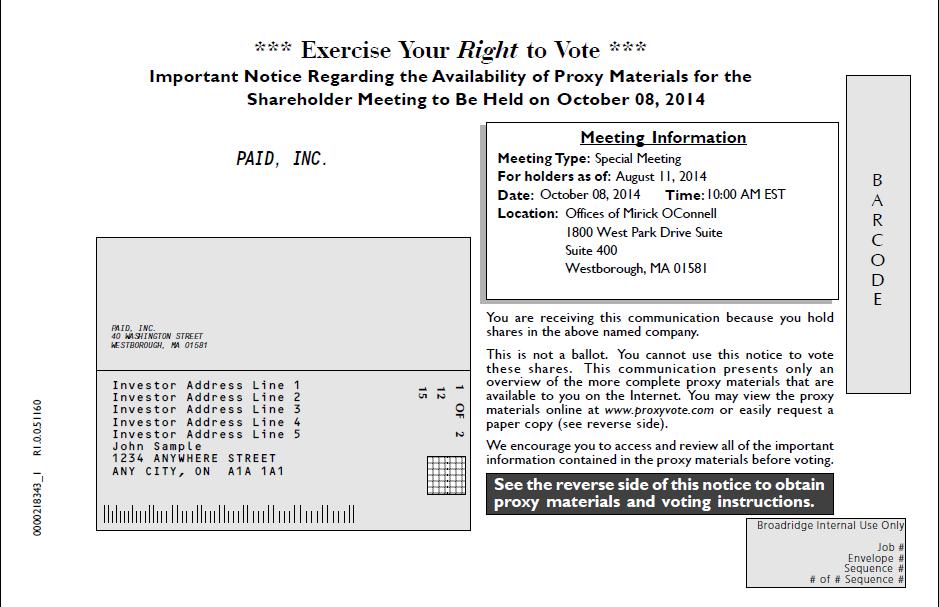

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on October 8, 2014

___________

To the Registrant |X|

Filed byStockholders of PAID, Inc.

NOTICE IS HEREBY GIVEN that a Party other than the Registrant |_|

Check the appropriate box:

|_| Preliminary Consent solicitation statement

|X| Definitive Consent solicitation statement

|_| Definitive Additional Materials

|_| Soliciting Material Under Rule 14a-12

|_| Confidential, For UseSpecial Meeting of the Commission

Only (as permitted by Rule 14a-6(e)(2))

SALES ONLINE DIRECT, INC.

(NameStockholders of Registrant As Specified In Its Charter)

------------------------------------------------------------------------------

(Name of Person(s) Filing Consent solicitation statement, if Other Than the

Registrant)

Payment of Filing Fee (Check the appropriate box):

|X| No fee required.

|_| Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11

(1) Title of each class of securities to which transaction applies:

- --------------------------------------------------------------------------------

(2) Aggregate number of securities to which transaction applies:

- --------------------------------------------------------------------------------

(3) Per unit price or other underlying value of transaction computed pursuant

to Exchange Act Rule 0-11 (set forth in the amount on which the filing fee

is calculated and state how it was determined):

- --------------------------------------------------------------------------------

(4) Proposed maximum aggregate value of transaction:

- --------------------------------------------------------------------------------

(5) Total fee paid:

- --------------------------------------------------------------------------------

|_| Fee paid previously with preliminary materials.

|_| Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

(1) Amount Previously Paid:

- --------------------------------------------------------------------------------

(2) Form, Schedule or Registration Statement No.:

- --------------------------------------------------------------------------------

(3) Filing Party:

- --------------------------------------------------------------------------------

(4) Date Filed:

- --------------------------------------------------------------------------------

SALES ONLINE DIRECT,PAID, Inc.

4 Brussels Street

Worcester, Massachusetts 01610

SOLICITATION OF CONSENTS

TO THE STOCKHOLDERS OF SALES ONLINE DIRECT, INC.:

The Board of Directors of Sales Online Direct, Inc. (the "Company")

requests your consent in writing, without, a meeting, to the following proposals:

1. To consider and approve an amendment to the Company's Certificate of

Incorporation to change the name of the Company to Paid, Inc.;

2. To consider and approve an amendment to the Company's Certificate of

Incorporation to effect a reverse stock split of all of the

outstanding shares of capital stock of the Company at a ratio of

one-for-six, to be effective at any time prior to 12 months after

the date of stockholder approval, in the discretion of the Board of

Directors; and

3. To consider and approve the Company's 2002 Stock Option Plan.

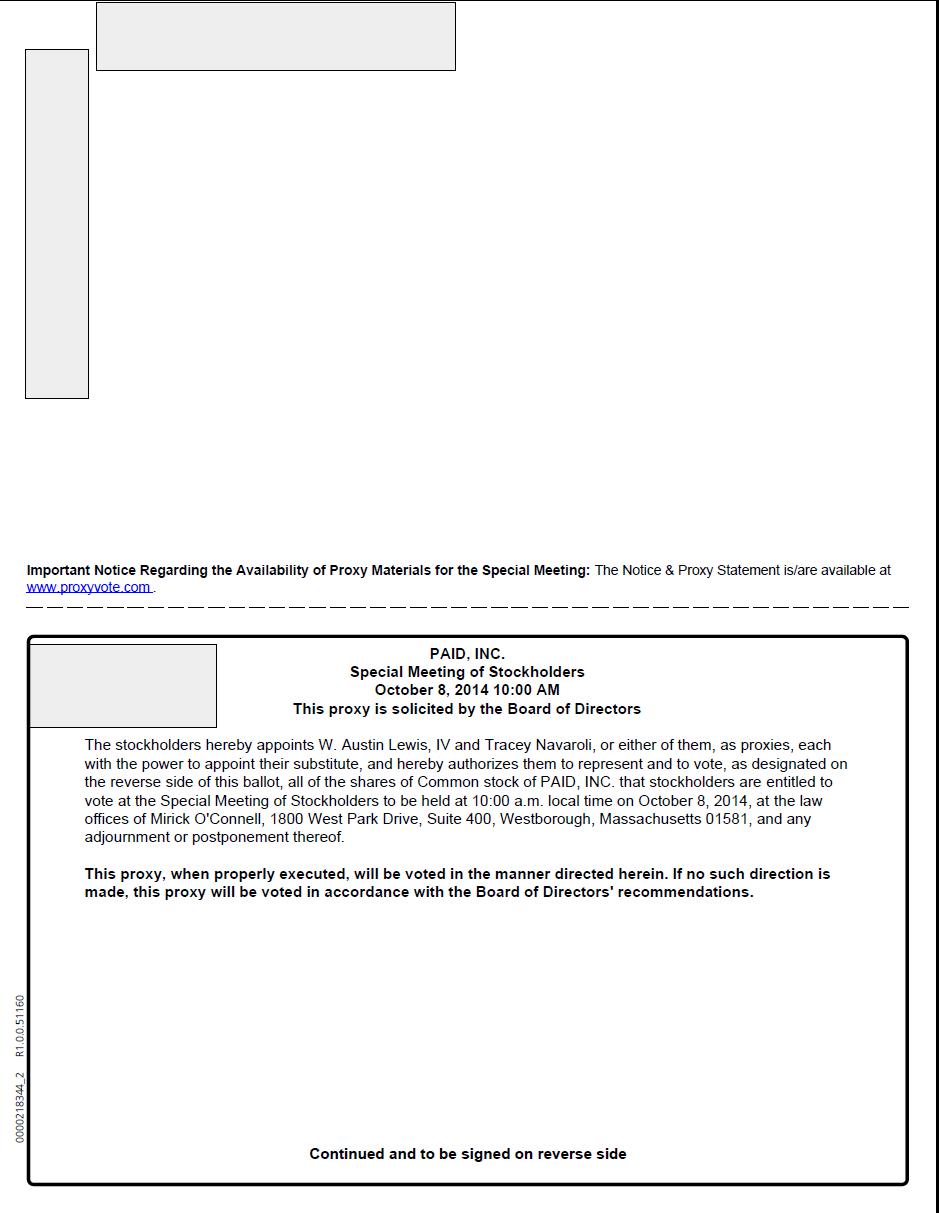

No meeting of stockholdersDelaware corporation, will be held at 1800 West Park Drive, Suite 400, Westborough, Massachusetts 01581, on Wednesday, October 8, 2014, at 10:00 a.m., local time, for the following purposes, as more fully described in connection withthe Proxy Statement accompanying this Consent

Solicitation because this Consent Solicitation is in lieunotice:

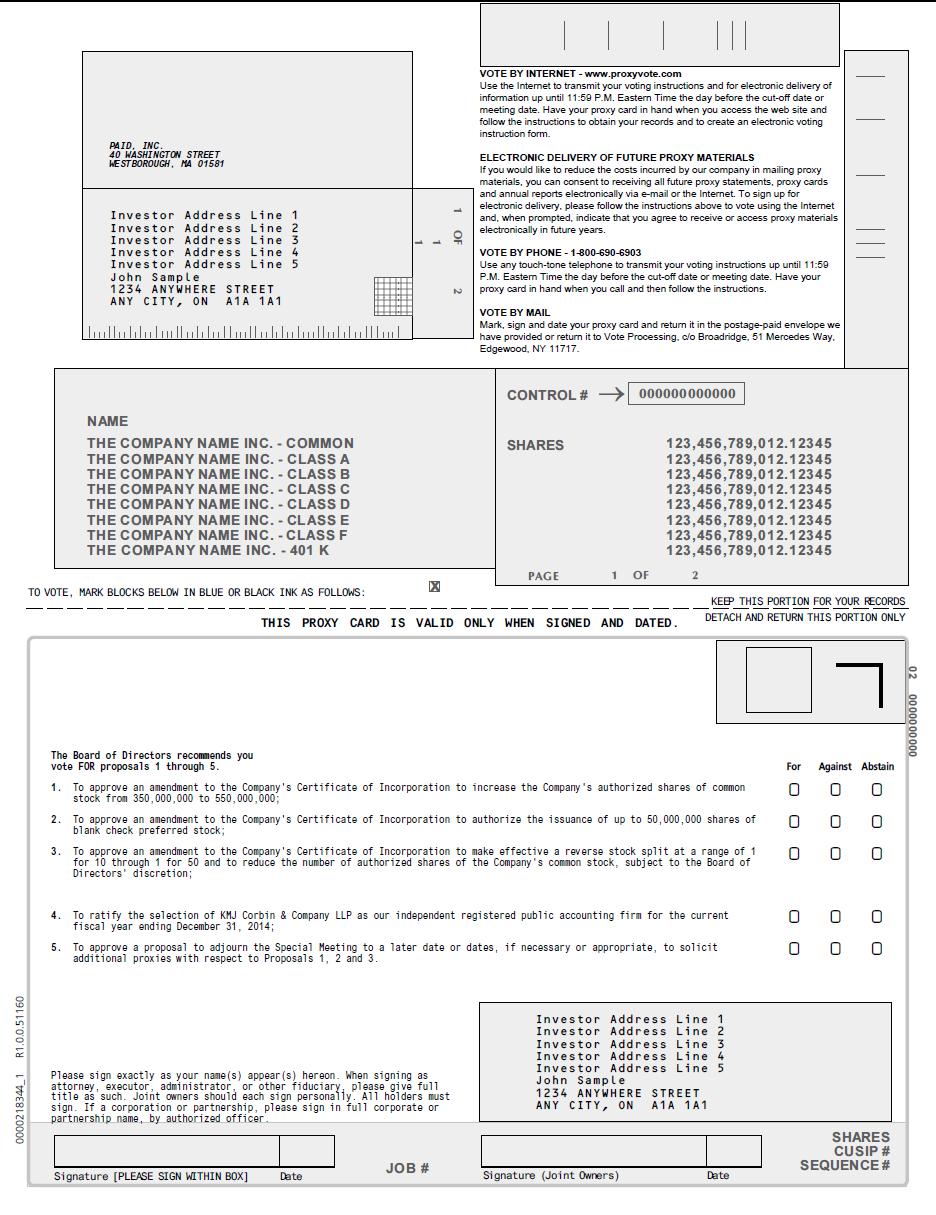

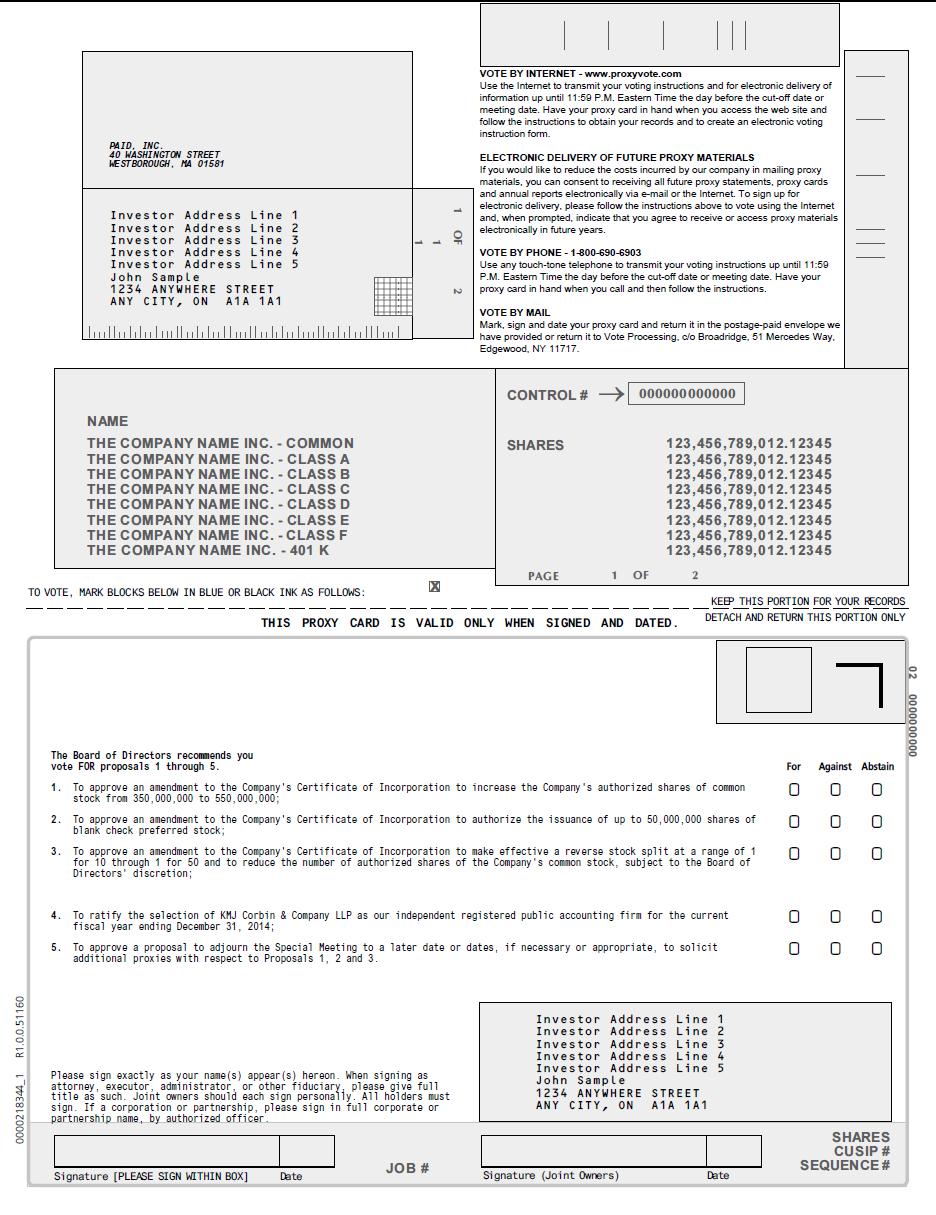

| 1. | To approve an amendment to the Company’s Certificate of Incorporation to increase the Company’s authorized shares of common stock from 350,000,000 to 550,000,000; |

| 2. | To approve an amendment to the Company’s Certificate of Incorporation to authorize the issuance of up to 50,000,000 shares of blank check preferred stock; |

| 3. | To approve an amendment to the Company’s Certificate of Incorporation to make effective a reverse stock split at a range of 1 for 10 through 1 for 50 and to reduce the number of authorized shares of the Company’s common stock, subject to the Board of Director’s discretion; |

| 4. | To ratify the selection of KMJ Corbin & Company LLP as our independent registered public accounting firm for the current fiscal year ending December 31, 2014; |

| 5. | To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies with respect to Proposals 1, 2 and 3. |

Stockholders who owned shares of a special meeting

of stockholders. The attached Consent Solicitation Statement is provided to you

pursuant to Rule 14a-3 under the Securities Exchange Act of 1934. Please read

the Consent Solicitation Statement thoroughly. YOUR BOARD OF DIRECTORS HAS

UNANIMOUSLY APPROVED EACH OF THE PROPOSALS AND UNANIMOUSLY RECOMMENDS THAT YOU

CONSENT TO EACH PROPOSAL.

Only holders of record ofour common stock of the Company as ofat the close of business on August 28, 2003 (the "Record Date")11, 2014 are entitled to receive notice of, attend and vote at the accompanying Consent SolicitationSpecial Meeting and any adjournment or postponement thereof. A complete list of these stockholders will be available at our corporate offices listed above during regular business hours for the ten days prior to the Special Meeting.

Your vote is important. Whether or not you plan to attend the Special Meeting, please vote as soon as possible. If you received notice of how to access the proxy materials over the Internet, a proxy card was not sent to you, but you may vote by telephone or online. If you received a proxy card and other proxy materials by mail, you may vote by mailing a completed proxy card, by telephone or over the Internet. For specific voting instructions, please refer to the information provided in the following Proxy Statement, and Consent andtogether with your proxy card or the voting instructions you receive by e-mail or that are provided via the Internet.

| By Order of the Board of Directors, /s/ W. Austin Lewis IV W. Austin Lewis IV President |

Westborough, Massachusetts

August ___, 2014

PAID, INC.

200 Friberg Parkway, Suite 4004

Westborough, Massachusetts 01581

(617) 861-6050

___________________

PROXY STATEMENT

___________________

For the Special Meeting of Stockholders to consent to eachbe held on October 8, 2014

Your proxy is being solicited on behalf of the proposals. Each stockholder is urged to sign, date, and mail the

accompanying Consent as promptly as possible in the enclosed self-addressed

envelope.

BY ORDER OF THE BOARD OF DIRECTORS,

Gregory Rotman

President

September 5, 2003

Worcester, Massachusetts

Your Consent is Important to Us

It is important that all of your shares are represented. To ensure that your

consent is counted, please complete, sign and date the enclosed consent as

promptly as possible and mail it in the enclosed envelope. You may revoke in

writing any consent that you give at any time before the consent is used by the

Company. If you have any questions, please contact Gregory Rotman, President, at

(508) 791-6710.

THIS CONSENT SOLICITATION STATEMENT IS BEING PROVIDED TO YOU BY THE

MANAGEMENT OF THE COMPANY

SALES ONLINE DIRECT, Inc.

4 Brussels Street

Worcester, Massachusetts 01610

CONSENT SOLICITATION STATEMENT

The Board of Directors (the “Board”) of Sales Online Direct,PAID, Inc., a Delaware corporation, for use at the Special Meeting of Stockholders (the "Company"“Special Meeting”) hereby

requests consent fromto be held at 10:00 a.m. local time on October 8, 2014 (the “Record Date”), or at any adjournment or postponement thereof, for the holderspurposes set forth in this Proxy Statement. The Special Meeting will be held at the law offices of the Company's common stock. Please indicate

your consent by SIGNING, DATING and MAILING the enclosed consent ("Consent")

using the enclosed envelope.

This Consent Solicitation Statement and the accompanying form of ConsentMirick O’Connell, 1800 West Park Drive, Suite 400, Westborough, Massachusetts 01581.

These proxy materials are first being mailedprovided on or about September 5, 2003August __, 2014 to holdersall stockholders as of the record ofdate, August 11, 2014. Stockholders who owned our common stock as ofat the close of business on August 28, 2003 (the "Record Date").

Requests for information regarding this Consent Solicitation Statement may

be directed to the attention of Gregory Rotman, President, at (508) 791-6710 or

delivered in writing to the Company at its principal executive office located at

4 Brussels Street, Worcester, MA 01610.

As part of this Consent Solicitation Statement, the Board of Directors of

the Company asks the holders of record to (1) consider and approve an amendment

to the Company's Certificate of Incorporation to change the name of the Company

to Paid, Inc. ("Proposal 1"); (2) consider and approve an amendment to the

Company's Certificate of Incorporation to effect a reverse stock split of all of

the outstanding shares of capital stock of the Company at a ratio of one-for-six

("Proposal 2"); and (3) consider and approve the Company's 2002 Stock Option

Plan ("Proposal 3"). To be approved, Proposals 1 and 2 require the consent of

persons holding not less than a majority of the issued and outstanding common

stock on the Record Date, and Proposal 3 requires the consent of persons holding

a majority of shares voting in which a has voted.

SOLICITATION, VOTING AND REVOCABILITY OF CONSENTS

As of the Record Date, the Company had 152,890,371 shares of common stock

issued and outstanding. Only holders of record of common stock as of the close

of business on the Record Date11, 2014 are entitled to consent to eachreceive notice of, attend and vote at the proposals.

Each shareSpecial Meeting. On the record date, there were 328,874,050 shares of our common stock outstanding.

All proxies will be voted in accordance with the instructions contained on those proxies, and if no choice is entitled to one vote. The sharesspecified, the proxies will be voted in favor of common stock

for which properly executed Consentseach matter set forth in the accompanying form are received will,

if no contrary instruction is received, be deemed submitted FOR eachNotice of the

proposals.

SECTION 228(c) OF THE DELAWARE GENERAL CORPORATION LAW ("DGCL") REQUIRES

THAT EACH CONSENT HAVE A DATED SIGNATURE OF EACH STOCKHOLDER WHO SIGNS THE

CONSENT. AN UNDATED CONSENT CANNOT BE COUNTED. In addition, under DGCL Section

228(c), none of the Consents will be effective to approve any of the proposals

unless Consents from holders of record on the Record Date owning the minimum

number of shares required to approve such proposal have been received within the

60-day period following the first dated Consent which is received with respect

to such proposal (the "Consent Solicitation Period"). The Consent providedMeeting. Any proxy may be executedrevoked by the record holder or pursuant to authority given by the written

proxy of any record holder.

2

Any Consent given pursuant to this solicitation is considered revocable by

the person giving ita stockholder at any time before it is usedexercised by delivery of written revocation to our corporate secretary.

References to the “Company,” “PAID,” “our,” “us” or “we” mean PAID, Inc.

VOTING AND RELATED MATTERS

Voting Procedures

As a stockholder of PAID, you have a right to vote on certain business matters affecting us. The proposals that will be presented at the Special Meeting and upon which you are being asked to vote are discussed below. Each share of our common stock you owned as of the record date entitles you to one vote on each proposal presented at the Special Meeting.

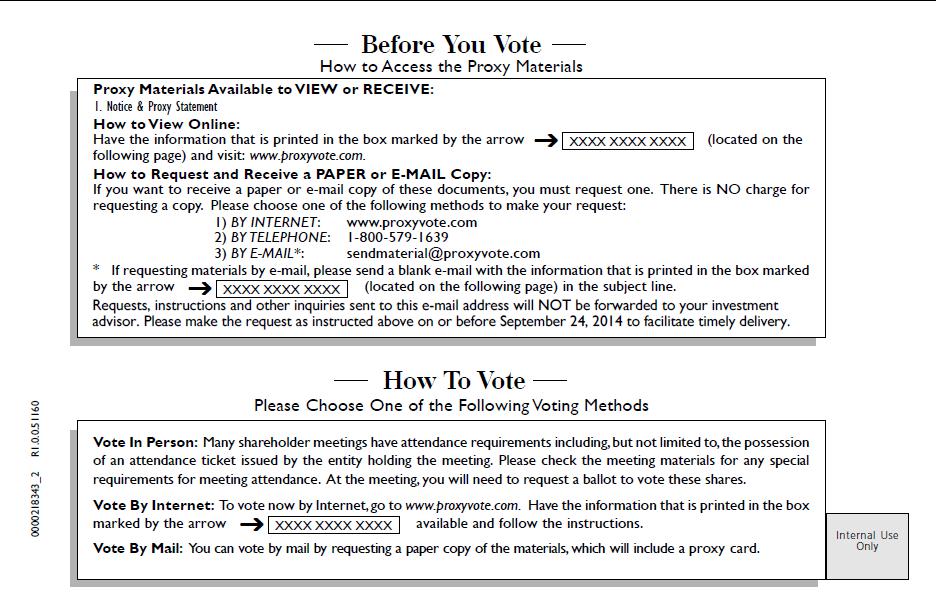

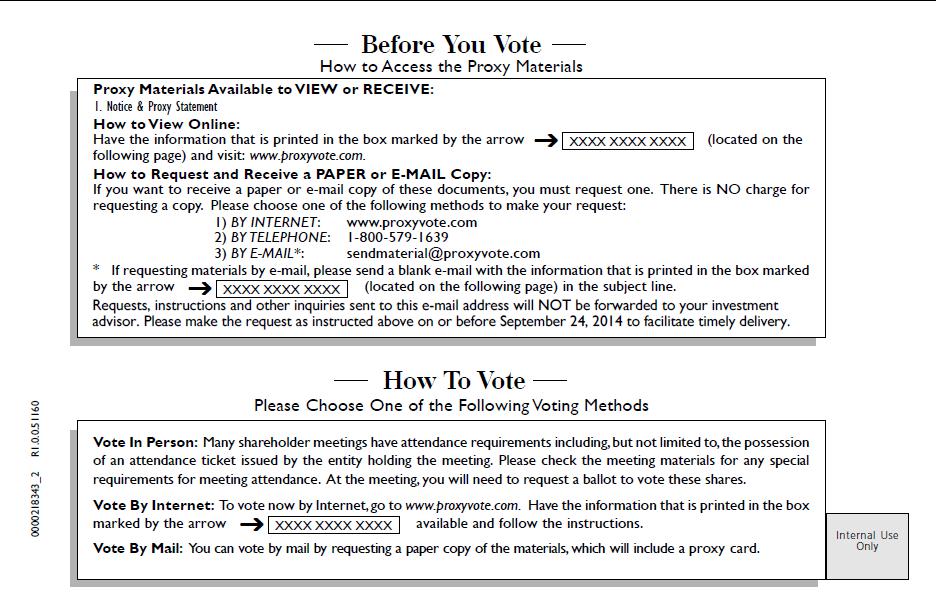

Electronic Delivery of Proxy Materials

Under rules adopted by the Company. Securities and Exchange Commission (“SEC”), we are furnishing proxy materials to our stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On or about August __, 2014, we sent our stockholders (other than those who previously requested electronic or paper delivery) a Notice of Internet Availability containing instructions on how to access our proxy materials on the Internet. The Notice of Internet Availability also instructs stockholders on how they can vote over the Internet or by telephone.

If you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail unless you elect otherwise.

Methods of Voting

You may vote over the Internet, by telephone, by mail or in person at the Special Meeting.

Voting over the Internet. You can vote via the Internet. The website address for Internet voting and the instructions for voting are provided on your Notice or proxy card. You will need to use the control number appearing on your Notice or proxy card to vote via the Internet. If you vote via the Internet you do not need to vote by telephone or return a proxy card.

Voting by Telephone. You can vote by telephone by calling the toll-free telephone number provided on your proxy card. You will need to use the control number appearing on your Notice or proxy card to vote by telephone. If you vote by telephone you do not need to vote over the Internet or return a proxy card.

Voting by Mail. If you received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope provided. You may also download the form of proxy card off the Internet and mail it to us. Please promptly mail your proxy card to ensure that it is received prior to the earlierclosing of the date on whichpolls at the Company has received Consents from persons

holdingSpecial Meeting.

Voting in Person at the minimum numberMeeting. If you attend the Special Meeting and plan to vote in person, we will provide you with a ballot at the Special Meeting. If your shares are registered directly in your name, you are considered the stockholder of record, and you have the right to vote in person at the Special Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Special Meeting, you will need to bring to the Special Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the Special Meeting. To do this, you must:

| · | enter a new vote over the Internet or by telephone, or by signing and returning a replacement proxy card; |

| · | provide written notice of the revocation to our Corporate Secretary at our principal executive offices, which are located at 200 Friberg Parkway, Suite 4004, Westborough, MA 01581; or |

| · | attend the Special Meeting and vote in person. |

Quorum and Voting Requirements To Approve Each Proposal

Stockholders of record at the close of business on August 11, 2014 are entitled to receive notice and vote at the meeting. On the record date, there were 328,874,050 issued and outstanding shares of our common stock. Each holder of our common stock voting at the meeting, either in person or by proxy, may cast one vote per share of common stock requiredheld on all matters to approve anybe voted on at the meeting. Holders of our preferred stock do not have voting rights at the proposalsmeeting.

The presence, in person or the endby proxy, of the Consent Solicitation Period, the Company

receives a written notice of revocation of a Consent or receives a duly executed

Consent bearing a later date, any earlier dated consent will be revoked. Upon

approval by holders of a majority of the outstanding shares of common stock entitled to vote constitutes a quorum for the transaction of business at the meeting. Assuming that a quorum is present, the following table summarizes the voting requirements to approve each proposal:

|

| | |

| Proposal | Vote Required | Broker Discretionary Voting Allowed |

| Proposal 1 - To approve an amendment to the Company’s Certificate of Incorporation to increase the Company’s authorized shares of common stock from 350,000,000 to 550,000,000. | A majority of the outstanding shares of common stock. | Yes |

| Proposal 2 - To approve an amendment to the Company’s Certificate of Incorporation to authorize the issuance of up to 50,000,000 shares of blank check preferred stock. | A majority of the outstanding shares of common stock. | No |

| Proposal 3 - To approve an amendment to the Company’s Certificate of Incorporation to make effective a reverse stock split at a range of 1 for 10 through 1 for 50 and to reduce the number of authorized shares of the Company’s common stock, subject to the Board of Director’s discretion. | A majority of the outstanding shares of common stock. | Yes |

| Proposal 4 - To ratify the selection of KMJ Corbin & Company LLP as our independent registered public accounting firm for the current fiscal year ending December 31, 2014. | The affirmative vote of a majority of the votes cast at the Special Meeting. | Yes |

| Proposal 5 - To approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies with respect to Proposals 1, 2 and 3. | The affirmative vote of a majority of the votes cast at the Special Meeting. | Yes |

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting. Such inspectors will also determine whether a quorum is present. The election inspectors will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, but as unvoted for purposes of determining the approval of any matter submitted to the stockholders for a vote. Accordingly, abstentions will have the same effect as a vote “AGAINST” Proposal 1, Proposal 2 and Proposal 3. Abstentions will have no effect on whether Proposal 4 or Proposal 5 is approved at the Special Meeting.

If your shares are held in street name and you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, is permitted to either leave your shares unvoted or vote your shares on matters that are considered routine. Proposal 1, Proposal 3, Proposal 4 and Proposal 5 are considered routine matters. Proposal 2 is considered a non-routine matter. Consequently, without your voting instructions, your brokerage firm (i) will not be able to vote your shares on Proposal 2, but (ii) will be able to vote your shares on Proposal 1, Proposal 3, Proposal 4 and Proposal 5. These unvoted shares, called “broker non-votes,” refer to shares held by brokers who have not received voting instructions from their clients and who do not have discretionary authority to vote on non-routine matters. Broker non-votes will not be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

Assuming that a quorum is present, broker non-votes (i) will have the same effect as a vote “AGAINST” Proposal 1, Proposal 2 and Proposal 3; and (ii) will have no effect on whether Proposal 4 or Proposal 5 is approved at the Special Meeting.

Voting of Proxies

When a proxy is properly executed and returned, the shares it represents will be voted at the Special Meeting as directed. If no specification is indicated, the shares will be voted:

| (1) | “FOR” Proposal 1 to approve an Amendment to the Company’s Certificate of Incorporation to increase the Company’s authorized shares of common stock from 350,000,000 to 550,000,000; |

| |

| (2) | “FOR” Proposal 2 to approve an amendment to the Company’s Certificate of Incorporation to authorize the issuance of up to 50,000,000 shares of blank check preferred stock; |

| |

| (3) | “FOR” Proposal 3 to approve an amendment to the Company’s Certificate of Incorporation to make effective a reverse stock split at a range of 1 for 10 through 1 for 50 and to reduce the number of authorized shares of the Company’s common stock, subject to the Board’s discretion; |

| |

| (4) | “FOR” Proposal 4 to ratify the selection of KMJ Corbin & Company LLP as our independent registered public accounting firm for the current fiscal year ending December 31, 2014; and |

| |

| (5) | “FOR” Proposal 5 to approve a proposal to adjourn the Special Meeting to a later date or dates, if necessary or appropriate, to solicit additional proxies with respect to Proposals 1, 2 and 3. |

If your shares are held in street name and you do not instruct your broker on how to vote your shares, your brokerage firm, in its discretion, may either leave your shares unvoted or vote your shares on matters which are considered routine. Proposal 1, Proposal 3, Proposal 4 and Proposal 5 are routine matters; Proposal 2 is not a routine matter. Consequently, without your voting instructions, your brokerage firm (i) will be able to vote your shares at the Special Meeting on Proposal 1, Proposal 3, Proposal 4 and Proposal 5 but (ii) will not be able to vote your shares at the Special Meeting on Proposal 2.

Voting Confidentiality

Proxies, ballots and voting tabulations are handled on a confidential basis to protect your voting privacy. This information will not be disclosed, except as required by law.

Voting Results

Voting results will be announced at the Special Meeting and published in a Form 8-K to be filed within four business days after the Special Meeting.

Householding of Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and related materials. This means that only one copy of our proxy statement and related materials may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of these proxy materials to any stockholder upon written or oral request to our Corporate Secretary by mail at 200 Friberg Parkway, Suite 4004, Westborough, MA 01581 or by phone at (617) 861-6050.

Any stockholder who wants to receive separate copies of proxy materials in the future, or any stockholder who is receiving multiple copies and would like to receive only one copy per household, should contact that stockholder's bank, broker, or other nominee record holder, or that stockholder may contact us at the above address and phone number.

Proxy Solicitation

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for reasonable expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by our directors, officers or employees, personally, or by mail, facsimile, telephone, messenger or via the Internet, without additional compensation.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

To the knowledge of the management of the Company the following table sets forth the beneficial ownership of our common stock as of the Record Date the Company shall promptly notify the stockholders who have not

consented to the action taken in accordance with Delaware law.

The Company will bear the cost of the solicitationAugust 11, 2014 of Consents by the

Boardeach of Directors. The Company may use the services of itsour directors and executive officers, and all of our directors to solicit consents from stockholders in person and by mail,

telephone and facsimile. Arrangements may also be made with brokers,

fiduciaries, custodians and nominees to send Consents, Consent Solicitation

Statementsexecutive officers as a group, and other materialbeneficial owners holding more than five percent of the Company’s issued and outstanding shares.

| Name of Beneficial Owner | | Amount and

Nature of

Beneficial

Ownership | | | Percent of

Class (3) | |

| W. Austin Lewis, IV | | | 37,689,145 | (1) | | | 11.55 | % |

| Terry Fokas | | | 0 | | | | 0 | % |

| Andrew Pilaro | | | 2,568,700 | (2) | | | 0.79 | % |

| All directors and executive officers as a group (3 individuals) | | | 40,257,845 | | | | 12.34 | % |

| (1) | Included are options to purchase 12,000,000 shares of the Company’s common stock and shares held for the following funds for which W. Austin Lewis, IV is the General Partner, 23,549,960 by Lewis Opportunity Fund, L.P. and 1,612,685 shares by LAM Waiting Game Fund LTD. |

| (2) | Includes 17,200 shares held indirectly as custodian for Mr. Pilaro's minor sons and options to purchase 2,500,000 shares of the Company's common stock all of which are vested. |

| (3) | Percentages are calculated on the basis of the amount of outstanding securities plus for such person or group, any securities that person or group has the right to acquire within 60 days. |

To the knowledge of the management of the Company, based solely on our review of SEC filings, no other stockholder is the beneficial ownersowner of more than five percent of the Company'sCompany’s common stock held of record by such persons, and the Company may reimburse them for

reasonable out-of-pocket expenses incurred by them in so doing.stock.

PROPOSAL 1

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO CHANGEINCREASE

AUTHORIZED SHARES OF COMMON STOCK FROM 350,000,000 TO 550,000,000

Our Board of Directors has approved, subject to stockholder approval, an amendment to our Certificate of Incorporation (the “Common Shares Increase Amendment”) to increase the number of authorized shares of the Company’s common stock from 350,000,000 to 550,000,000.

If the Common Shares Increase Amendment is approved by our stockholders at the Special Meeting, we intend to file the Common Shares Increase Amendment with the Secretary of State of Delaware, substantially in the form of Appendix A hereto (provided that, if both the Common Shares Increase Amendment and the Blank Check Preferred Amendment (see Proposal 2 below) are approved by stockholders at the Special Meeting, we may file a single amendment for both actions) with the Secretary of State of Delaware as soon as practicable following the Special Meeting. The increase in authorized shares of common stock under the Common Shares Increase Amendment will be effective upon filing with the Secretary of State of Delaware.

Outstanding Shares and Purpose of the Proposal

Our Certificate of Incorporation currently authorizes us to issue a maximum of 350,000,000 shares of common stock, par value $0.001 per share. Our issued and outstanding securities, as of August 11, 2014, on a fully diluted basis, are as follows:

| · | 328,874,050 shares of common stock; and |

| · | Stock options convertible into 19,250,000 shares of common stock at an average exercise price of $0.095 per share. |

The Board believes that the increase in authorized shares of common stock will provide the Company greater flexibility with respect to the Company’s capital structure for purposes including additional equity financings and stock based acquisitions.

Effects of the Increase in Authorized Common Stock

The additional shares of common stock will have the same rights as the presently authorized shares, including the right to cast one vote per share of common stock. Although the authorization of additional shares will not, in itself, have any effect on the rights of any holder of our common stock, the future issuance of additional shares of common stock (other than by way of a stock split or dividend) would have the effect of diluting the voting rights and could have the effect of diluting earnings per share and book value per share of existing stockholders.

At present, the Board of Directors has no immediate plans to issue the additional shares of common stock to be authorized by the Common Shares Increase Amendment. However, it is possible that some of these additional shares could be used in the future for various other purposes without further stockholder approval, except as such approval may be required in particular cases by our charter documents, applicable law or the rules of any stock exchange or other market on which our securities may then be listed. These purposes may include: raising capital, providing equity incentives to employees, officers or directors, establishing strategic relationships with other companies, and expanding the Company’s business or product lines through the acquisition of other businesses or products.

We could also use the additional shares of common stock that will become available pursuant to the Common Shares Increase Amendment to oppose a hostile takeover attempt or to delay or prevent changes in control or management of the Company. Although the proposal to increase the authorized common stock has not been prompted by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at the Company), nevertheless, stockholders should be aware that the Common Shares Increase Amendment could facilitate future efforts by us to deter or prevent changes in control of the Company, including transactions in which stockholders of the Company might otherwise receive a premium for their shares over then current market prices. However, the Board of Directors has a fiduciary duty to act in the best interests of the Company's stockholders at all times.

Required Vote

Approval of the Common Shares Increase Amendment requires the receipt of the affirmative vote of a majority of the shares of the Company's common stock issued and outstanding as of the record date.

RECOMMENDATION OF THE COMPANY'S NAME (Proposal 1)BOARD FOR PROPOSAL 1:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS

VOTE TO APPROVE THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF

INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF THE

COMPANY’S COMMON STOCK FROM 350,000,000 TO 550,000,000

PROPOSAL 2

APPROVAL OF AMENDMENT TO CERTIFICATE OF INCORPORATION TO AUTHORIZE

THE ISSUANCE OF UP TO 50,000,000 SHARES OF BLANK CHECK PREFERRED STOCK

Our Board of Directors has approved, subject to stockholder approval, an amendment to our Certificate of Incorporation (the “Blank Check Preferred Amendment”) to authorize the issuance of up to 50,000,000 shares of blank check preferred stock.

If the Blank Check Preferred Amendment is approved by our stockholders at the Special Meeting, we intend to file the Blank Check Preferred Amendment with the Secretary of State of Delaware, substantially in the form of Appendix B hereto (provided that, if both the Common Shares Increase Amendment and the Blank Check Preferred Amendment are approved by stockholders at the Special Meeting, we may file a single amendment for both actions) with the Secretary of State of Delaware as soon as practicable following the Special Meeting.

Outstanding Shares and Purpose of the Proposal

Our Certificate of Incorporation currently authorizes us to issue a maximum of 350,000,000 shares of common stock, par value $0.001 per share. Our issued and outstanding securities, as of August 11, 2014, on a fully diluted basis, are as follows:

| · | 328,874,050 shares of common stock; and |

| · | Stock options convertible into 19,250,000 shares of common stock at an average exercise price of $0.095 per share. |

Upon filing with the Delaware Secretary of State, the Blank Check Preferred Amendment will authorize the issuance of up to 50,000,000 shares of preferred stock, $0.001 par value. The Board of Directors will be authorized to fix the designations, rights, preferences, powers and limitations of each series of the preferred stock.

The term "blank check" preferred stock refers to stock which gives the board of directors of a corporation the flexibility to create one or more series of preferred stock, from time to time, and to determine the relative rights, preferences, powers and limitations of each series, including, without limitation: (i) the number of shares in each series, (ii) whether a series will bear dividends and whether dividends will be cumulative, (iii) the dividend rate and the dates of dividend payments, (iv) liquidation preferences and prices, (v) terms of redemption, including timing, rates and prices, (vi) conversion rights, (vii) any sinking fund requirements, (viii) any restrictions on the issuance of additional shares of any class or series, (ix) any voting rights and (x) any other relative, participating, optional or other special rights, preferences, powers, qualifications, limitations or restrictions. Any issuances of preferred stock by the Company will need to be approved the board of directors.

The Board of Directors believes that the authorization of shares of preferred stock is desirable because it will provide the Company with increased flexibility of action to meet future working capital and capital expenditure requirements through equity financings without the delay and expense ordinarily attendant on obtaining further stockholder approvals. The Board of Directors believes that the authorization of blank check preferred stock will improve the Company's ability to attract needed investment capital, as various series of the preferred stock may be customized to meet the needs of any particular transaction or market conditions.

Effects of Blank Check Preferred Amendment on Current Stockholders

The shares of preferred stock to be authorized pursuant to the Blank Check Preferred Amendment could be issued, at the discretion of the Board, for any proper corporate purpose, without further action by the stockholders other than as may be required by applicable law. The Company proposesdoes not currently have any plan or proposal to amendissue any shares of preferred stock. Existing stockholders do not have preemptive rights with respect to future issuance of preferred stock by the Company and their interest in the Company could be diluted by such issuance with respect to any of the following: earnings per share, voting, liquidation rights and book and market value.

The Board of Directors will have the power to issue the shares of preferred stock in one or more classes or series with such preferences and voting rights as the Board of Directors may fix in the resolution providing for the issuance of such shares. The issuance of shares of preferred stock could affect the relative rights of the Company's shares of common stock. Depending upon the exact terms, limitations and relative rights and preferences, if any, of the shares of preferred stock as determined by the Board of Directors at the time of issuance, the holders of shares of preferred stock may be entitled to a higher dividend rate than that paid on the common stock, a prior claim on funds available for the payment of dividends, a fixed preferential payment in the event of liquidation and dissolution of the Company, redemption rights, rights to convert their shares of preferred stock into shares of common stock, and voting rights which would tend to dilute the voting control of the Company by the holders of shares of common stock. Depending on the particular terms of any series of the preferred stock, holders thereof may have significant voting rights and the right to representation on the Company's Board of Directors. In addition, the approval of the holders of shares of preferred stock, voting as a class or as a series, may be required for the taking of certain corporate actions, such as mergers.

The issuance of shares of preferred stock may have the effect of discouraging or thwarting persons seeking to take control of the Company through a tender offer, proxy fight or otherwise or seeking to bring about removal of incumbent management or a corporate transaction such as a merger. For example, the issuance of shares of preferred stock in a public or private sale, merger or in a similar transaction may, depending on the terms of the series of preferred stock dilute the interest of a party seeking to take over the Company. Further, the authorized preferred stock could be used by the Board of Directors for adoption of a stockholder rights plan or "poison pill."

The Blank Check Preferred Amendment was not proposed in response to, or for the purpose of deterring, any current effort to obtain control of the Company or as an anti-takeover measure. It should be noted that any action taken by the Company to discourage an attempt to acquire control of the Company might result in stockholders not being able to participate in any possible premiums which might be obtained in the absence of anti-takeover provisions. Any transaction which may be so discouraged or avoided could be a transaction that the Company's stockholders might consider to be in their best interests. However, the Board of Directors has a fiduciary duty to act in the best interests of the Company's stockholders at all times.

Required Vote

Approval of the Blank Check Preferred Amendment requires the receipt of the affirmative vote of a majority of the shares of the Company's common stock issued and outstanding as of the record date.

RECOMMENDATION OF THE BOARD FOR PROPOSAL 2:

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS

VOTE TO APPROVE THE AMENDMENT TO THE COMPANY’S CERTIFICATE OF

INCORPORATION TO AUTHORIZE THE ISSUANCE OF UP TO 50,000,000 SHARES OF

BLANK CHECK PREFERRED STOCK

PROPOSAL 3

APPROVAL TO AMEND THE COMPANY’S CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT AT A RANGE OF 1 FOR 10 THROUGH 1 FOR 50

AND TO REDUCE THE NUMBER OF

AUTHORIZED SHARES OF THE COMPANY’S COMMON STOCK, SUBJECT TO

THE BOARD’S DISCRETION

The Board has approved, and is hereby soliciting stockholder approval of, an amendment to the Company’s Certificate of Incorporation to changemake effective a reverse stock split of the nameCompany’s common stock at a ratio of not less than one-for-ten and not more than one-for-fifty, subject to the Board’s discretion to determine, without any further action by stockholders, not to proceed with a reverse stock split if it determines that a reverse stock split is no longer in the best interest of the Company from Sales Online Direct, Inc.and its stockholders. The language of the new Article Fourth of the Certificate of Incorporation which would be contained in an amendment is set forth in Appendix C to Paid, Inc.

this Proxy Statement (the “Reverse Stock Split Amendment”). A vote for this Proposal 3 will constitute approval of the Reverse Stock Split Amendment providing for the combination of any whole number of shares of common stock between and including ten and fifty into one share of common stock and will grant the Board the authority to select which of the approved exchange ratios within that range will be implemented. If stockholders approve this proposal, the Board will have the authority, but not the obligation, in its sole discretion and without further action on the part of the stockholders, to select one of the approved reverse stock split ratios and effect the approved reverse stock split by filing the Reverse Stock Split Amendment with the Secretary of State of the State of Delaware at any time after the approval of the Reverse Stock Split Amendment. If the Reverse Stock Split Amendment is approved by stockholders and has not been filed with the Secretary of State of the State of Delaware by the close of business on the first anniversary of the date on which the stockholders approved it, the Board will abandon the Reverse Stock Split Amendment. If the reverse stock split is implemented, the Reverse Stock Split Amendment also would reduce the number of authorized shares of our common stock as set forth below but would not change the par value of a share of our common stock.Except for any changes as a result of the treatment of fractional shares, each stockholder will hold the same percentage of common stock outstanding immediately following the reverse stock split as such stockholder held immediately prior to the reverse stock split.

The Board believes that stockholder approval of Directors considersan exchange ratio range (rather than an exact exchange ratio) provides the Board with maximum flexibility to achieve the purposes of the reverse stock split. If the stockholders approve this Proposal 3, the reverse stock split will be made effective, if at all, only upon a determination by the Board that the reverse stock split is in the Company’s and its stockholders’ best interests at that time. In connection with any determination to make effective the reverse stock split, the Board will set the time for such a split and select a specific ratio within the range. These determinations will be made by the Board with the intention to create the greatest marketability for our common stock based upon prevailing market conditions at that time.

The Board reserves its right to elect to abandon the reverse stock split if it determines, in its sole discretion, that this proposal is no longer in the best interest of the Company and its stockholders.

Purpose of the Reverse Stock Split Amendment

The purpose of the reverse stock split is to increase the per share trading value of the common stock. The Board intends to make effective the proposed changereverse stock split only if it believes that a decrease in the number of shares outstanding is likely to improve the Company's nametrading price for the common stock, and only if the implementation of a reverse stock split is determined by the Board to be in the best interests of the Company and its stockholders. The Board may exercise its discretion not to implement a reverse stock split.

A reverse stock split would allow a broader range of Directors believesinstitutions to invest in the common stock (namely, funds that are prohibited from buying stocks with a price below a certain threshold), potentially increasing the trading volume and liquidity of the common stock. A reverse stock split would also help increase analyst and broker interest in the common stock, as their policies can discourage them from following or recommending companies with lower stock prices. Because of the trading volatility often associated with lower-priced stock, many brokerage houses and institutional investors have adopted internal policies and practices that either prohibit or discourage them from investing in such stocks or recommending them to their customers. Some of those policies and practices may also function to make the processing of trades in lower-priced stocks economically unattractive to brokers.

Impact of the Reverse Stock Split Amendment if Implemented

If approved and effected, the reverse stock split will be realized simultaneously and in the same ratio for all of the common stock. The reverse stock split will affect all holders of the common stock uniformly and will not affect any stockholder’s percentage ownership interest, or voting power, in the Company (subject to the treatment of fractional shares). As described below, holders of common stock otherwise entitled to a fractional share as a result of the reverse stock split will receive a cash payment in lieu of such fractional share. These cash payments will reduce the number of post-reverse stock split holders of the common stock to the extent there are at the time the reverse stock split is made effective, stockholders who would otherwise receive less than one share of common stock after the reverse stock split. In addition, the reverse stock split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The principal effects of the Reverse Stock Split Amendment will be that:

| • | depending on the ratio for the reverse stock split selected by the Board, each ten or fifty shares of common stock owned by a stockholder, or any whole number of shares of common stock between ten and fifty, as determined by the Board, will be combined into one new share of common stock; |

| |

| • | the number of shares of common stock issued and outstanding will be reduced from approximately 330,000,000 to a range of approximately 33,000,000 to 165,000,000, depending upon the reverse stock split ratio selected by the Board; |

| |

| • | the number of authorized shares of common stock will be reduced from 350,000,000 (or 550,000,000 if the Company’s stockholders approve Proposal 2 described in this Proxy Statement) to a range of approximately 7,000,000 (or 11,000,000 if Proposal 1 is approved) to 35,000,000 (or 55,000,000 if Proposal 1 is approved) depending upon the reverse stock split ratio between ten and fifty chosen by the Board; |

| • | based upon the reverse stock split ratio selected by the Board, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, and other convertible or exchangeable securities entitling the holders thereof to purchase, exchange for, or convert into, shares of common stock, which will result in approximately the same aggregate price being required to be paid for such options and restricted stock awards and units upon exercise immediately preceding the reverse stock split; and |

| |

| • | the number of shares reserved for issuance or pursuant to the securities or plans described in the immediately preceding bullet will be reduced proportionately based upon the reverse stock split ratio selected by the Board. |

If Proposal 1 is Not Approved.

The table below illustrates the effect, as of the Record Date of August 11, 2014 and assuming that Proposal 1 is not approved so that the change will result innumber of authorized shares of common stock remains at 350,000,000, of a more recognizable corporate

identity, better reflectingreverse stock split at certain ratios on (i) the Company's future plans. If permitted,shares of common stock outstanding; (ii) the new

name will also matchshares of common stock reserved for issuance, (iii) the Company's "PAID"reduced number of total authorized shares of common stock symbol. The new name will also

match an existing registered domain name and website of the Company. The Board

also believes that the name change will enhance marketing capabilities and will

reflect the Company's expanded direction, such as with respect to sales of

online management tools to other online sellers, including a shipping

calculator. If approved, the new name will become effective upon the Company's

filing of the Certificate of Amendment with the Secretary of State of the State

of Delaware. The change in corporate name will be accomplished by amending the

first paragraph of the Company'sunder our Certificate of Incorporation, to read:

"FIRST: and (iv) the resulting number of shares of common stock available for issuance:

| | Common Shares Outstanding | Common Shares Reserved for Issuance | Total Authorized Common Shares | Common Shares Authorized and Available (% of total authorized) |

Before Reverse Stock Split | 328,874,050 | 21,000,000 | 350,000,000 | 125,950 (.359%) |

| One-for-ten | 32,887,405 | 2,100,000 | 35,000,000 | 12,595 (.359%) |

| One-for-twenty-five | 13,154,962 | 840,000 | 14,000,000 | 5,038 (.359%) |

| One-for-fifty | 6,577,481 | 420,000 | 7,000,000 | 2,519 (.359%) |

If Proposal 1 is Approved.

The nametable below illustrates the effect, as of the corporationRecord Date of August 11, 2014 and assuming that Proposal 1 is Paid, Inc."

The Board of Directors has unanimously approved the proposed charter

amendment. The Board of Directors reserves the right, notwithstanding

stockholder approval and without further action by the stockholders, not to

proceed with the change in name of the Company if, at any time prior to filing

the amendment with the Secretary of State of Delaware, the Board of Directors,

in its sole discretion, determinesso that the change in namenumber of authorized shares of designated as common stock is increased to 550,000,000, of a reverse stock split at certain ratios on (i) the Company is no

longer inshares of common stock outstanding; (ii) the best interestsshares of common stock reserved for issuance, (iii) the Company and its stockholders.

Approval to amend thereduced number of total authorized shares of common stock under our Certificate of Incorporation, and (iv) the resulting number of shares of common stock available for issuance:

| | Common Shares Outstanding | Common Shares Reserved for Issuance | Total Authorized Common Shares | Common Shares Authorized and Available (% of total authorized) |

Before Reverse Stock Split | 328,874,050 | 21,000,000 | 550,000,000 | 200,125,950 (36.39%) |

| One-for-ten | 32,887,405 | 2,100,000 | 55,000,000 | 20,012,595 (36.39%) |

| One-for-twenty-five | 13,154,962 | 840,000 | 22,000,000 | 8,005,038 (36.39%) |

| One-for-fifty | 6,577,481 | 420,000 | 11,000,000 | 4,002,519 (36.39%) |

Certain Risks Associated with the Reverse Stock Split

| • | If the reverse stock split is made effective and the market price of the common stock declines, the percentage decline may be greater than would occur in the absence of a reverse stock split. The market price of the common stock will, however, also be based on performance and other factors, which are unrelated to the number of shares outstanding. |

| • | There can be no assurance that the reverse stock split will result in any particular price for the common stock. As a result, the trading liquidity of the common stock may not necessarily improve. |

| • | There can be no assurance that the market price per share of the common stock after a reverse stock split will increase in proportion to the reduction in the number of shares of the common stock outstanding before the reverse stock split. For example, based on the closing price of the common stock on the Record Date of August 11, 2014 of $.07 per share, if the reverse stock split were implemented and approved for a reverse stock split ratio of one-for-fifty, there can be no assurance that the post-split market price of the common stock would be $3.50 or greater. Accordingly, the total market capitalization of the common stock after the reverse stock split may be lower than the total market capitalization before the reverse stock split. Moreover, in the future, the market price of the common stock following the reverse stock split may not exceed or remain higher than the market price prior to the reverse stock split. |

| | |

| • | Because the number of issued and outstanding shares of common stock would decrease as result of the reverse stock split, the number of authorized but unissued shares of common stock may increase on a relative basis. If the Company issues additional shares of common stock, then the ownership interest of the Company’s current stockholders would be diluted, possibly substantially. |

| • | There are certain agreements, plans and proposals that may have material anti-takeover consequences. The proportion of unissued authorized shares to issued shares could, under certain circumstances, have an anti-takeover effect. For example, the issuance of a large block of common stock could dilute the stock ownership of a person seeking to make effective a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of the Company with another company. |

| | |

| • | The reverse stock split may result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares. |

The Board intends to changemake effective the Company's

name underreverse stock split only if it believes that a decrease in the DGCL requiresnumber of shares is likely to improve the affirmative votetrading price of the holders of a majoritycommon stock and if the implementation of the outstanding shares of votingreverse stock of the Company. The Company has no

class of voting stock outstanding other than the common stock.

Section 228 of the DGCL provides generally that, unless the Company's

Certificate of Incorporation provides otherwise, stockholders may take action

without a meeting of stockholders and without prior notice if a consent or

consents, setting forth in writing the action so taken,split is signeddetermined by the holders

of outstanding voting stock holding not less than the minimum number of votes

that would be necessary to approve such action at a meeting of stockholders.

Under the applicable provisions of the

3

DGCL, the proposed charter amendment is authorized when written consents from

holders of record of a majority of the outstanding shares of voting stock on the

Record Date are signed and delivered to the Company. Withholding of consents,

abstentions, and broker non-votes all have the effect of a vote against the

proposed charter amendment.

The charter amendment will become effective upon its filing with the

Secretary of State of Delaware. The proposed form to amend the Company's

Certificate of Incorporation to change the Company's name is attached as

Appendix A and is incorporated by reference in this Consent Solicitation, which

form is, however, subject to change as may be necessary or required by the

Delaware Secretary of State.

Under DGCL Section 262, stockholders are not entitled to appraisal rights,

whether or not stockholders consent to the proposed charter amendment. There may

exist other rights or actions under state law for stockholders.

The Board of Directors recommends a vote for the proposal to amend to the

Company's Certificate of Incorporation to change the name of the Company to

Paid, Inc.

AMENDMENT TO CERTIFICATE OF INCORPORATION TO

EFFECT A REVERSE STOCK SPLIT (Proposal 2)

The Company also proposes to authorize the Company's Board of Directors to

effect a reverse split of all outstanding shares of the Company's common stock

by an amendment to the Company's Certificate of Incorporation. The amendment

would effect a one-for-six reverse stock split. The Board of Directors would

have the sole discretion to elect, as it determines to be in the best interests of the Company and its stockholders, whether or not to amend the Company's

Certificate of Incorporation to effect astockholders. The reverse stock split at any time prior

to 12 months fromand the date of stockholder approval. If the reverse stock split

authorized by the stockholdersreduction in shares is not implemented within 12 months aftera “going private” transaction and is not the date of stockholder approval, the amendment will be deemed abandoned, without

any further effect. In that case the Board of Directors may again seek

stockholder approval at a future date for a reverse stock split if it deems a

reverse split to be advisable at that time. The Board of Directors believes that

approvalfirst step of a proposal granting this discretion to the board, rather than

approval of an immediate reverse stock split, provides the board with maximum

flexibility to react to current market conditions and to therefore act in the

best interests of the Company and its stockholders.

If the Board of Directors elects to implement the reverse stock split, the

number of issued and outstanding shares of common stock would automatically be

changed into one-sixth of a share of common stock. “going private” transaction.

Effective Time

The par value of the common

stock would remain unchanged at $0.001 per share, and the number of authorized

shares of common stock would remain unchanged. Theproposed reverse stock split would become effective uponas of 11:59 p.m., Eastern Time (the “Effective Time”), on the date of filing the amendment to the Company's Certificate of

Incorporation with the Delaware Secretary of State.

Reasons for the Reverse Stock Split The BoardAmendment with the office of Directors believes that the current per-share priceSecretary of State of the State of Delaware. Except as explained below with respect to fractional shares, at the Effective Time, all shares of the common stock has limited the effective marketability of the common stock because

of the reluctance of many brokerage firmsissued and institutional investors to

recommend lower-priced stocks to their clients or to hold them in their own

portfolios. Further, analysts at many brokerage firms do not monitor the trading

activity or otherwise provide research coverage of lower priced or penny stocks.

Certain policiesoutstanding immediately prior thereto will be combined, automatically and practices of the securities industry may tend to discourage

individual brokers within those firms from dealing in lower-priced stocks. Some

of these policies and practices involve time-consuming procedures that make the

4

handling of lower priced stocks economically unattractive. The brokerage

commission on a sale of lower priced stock also may represent a higher

percentage of the sale price than the brokerage commission on a higher priced

issue. Any reduction in brokerage commissions resulting from a reverse stock

split may be offset, however, by increased brokerage commissions required to be

paid by stockholders selling "odd lots" created by the reverse stock split.

In addition, the Company's common stock is listed for tradingwithout any action on the OTC

Bulletin Board under the symbol "PAID". On the Record Date the reported closing

pricepart of the common stock on the OTC Bulletin Board was $.109 per share. The

Board of Directors desires to have the Company's common stock eventually listed

with Nasdaq if possible. The Company currently does not qualify for admission to

either the Nasdaq National Market or the Nasdaq SmallCap Market. To qualify in

part for listing, the market price of the Company's common stock must increase

substantially. The Board of Directors hopes that the reverse stock split will

result in fewer shares atstockholders, into a higher price. Even after the reverse split, the

Company anticipates that its per share price of its common stock would be below

the $4.00 level required for admission to the Nasdaq SmallCap Market ($1.00 for

continued listing) or the $5.00 level required for the Nasdaq National Market

($1.00 to $3.00 for continued listing). Currently, the Company also falls below

additional Nasdaq SmallCap Market listing requirements, including the

requirement to have either $5,000,000 in stockholders' equity, $50,000,000 in

market value of listed securities, or $750,000 in net income for two of the last

three fiscal years.

In evaluating the reverse stock split, the Company's Board of Directors

took into consideration negative factors associated with reverse stock splits.

These factors include the negative perception of reverse stock spits held by

many investors, analysts and other stock market participants, as well as the

fact that the stock price of some companies that have effected reverse stock

splits has subsequently declined back to pre-reverse stock split levels. The

Board of Directors, however, determined that these negative factors were

outweighed by the potential benefits.

Potential Effects of the Reverse Stock Split

The immediate effect of a one-for-six reverse stock split would be to

reduce the number of shares of common stock outstanding, and to increase the

trading price of the Company's common stock. However, the effect of any reverse

stock split upon the market price of the Company's common stock cannot be

predicted, and the history of reverse stock splits for companies in similar

circumstances is varied. The Company cannot assure you that the trading price of

the Company's common stock after the reverse stock split will rise in exact

proportion to the reduction in thelesser number of shares of the Company's common stock outstanding as a result of the reverse stock split. Also, as stated above,

the Company cannot assure you that a reverse stock split would lead to a

sustained increasecalculated in the trading price of the Company's common stock, or that

the trading price would reach any of the thresholds required by the Nasdaq

markets. The trading price of the Company's common stock may change due to a

variety of other factors, including the Company's operating results, other

factors related to the Company's business, and general market conditions.

Based on 152,890,371 shares of common stock outstanding as of the Record

Date, the number of shares followingaccordance with the reverse stock split will be 25,481,729,

subject to rounding of fractional shares.

The resulting decrease in the number of shares of the Company's common

stock outstanding could potentially impact the liquidity of the Company's common

stock on the OTC Bulletin Board, especially in the case of larger block trades.

5

Effects on Ownership by Individual Stockholders

If the Company implements the one-for-six reverse stock split, the number

of shares of common stock held by each stockholder would be reduced by dividing

the number of shares held immediately before the reverse stock split by six, and

then rounding up to the nearest whole share. The reverse stock split would

affect the Company's common stock uniformly and would not affect any

stockholder's percentage ownership interests in the Company or proportionate

voting power, except to the extent that whole shares will be exchanged in lieu

of fractional shares.

Effect on Options, Warrants and Other Securities

All outstanding shares of options, warrants, notes, debentures and other

securities entitling their holders to purchase shares of the Company's common

stock would be adjusted as a result of the reverse stock split, as requiredratio determined by the terms of these securities. In particular,Board.

After the conversion ratio for each

instrument would be reduced, and the exercise price, if applicable, would be

increased, in accordance with the terms of each instrument and based on the

one-for-six exchange ratio. Also, the number of shares reserved for issuance

under the Company's existing stock option plans would be reduced proportionally

based on the one-for-six exchange ratio. None of the rights currently accruing

to holders ofEffective Time, the common stock options, warrants, notes, debentures or otherwill have a new committee on uniform securities convertible into commonidentification procedures (“CUSIP”) number, which is a number used to identify the Company’s equity securities, and stock wouldcertificates with the older CUSIP number will need to be affectedexchanged for stock certificates with the new CUSIP number by following the reverse stock

split.

Other Effects on Outstanding Shares

If a reverse stock split were implemented,procedures described below.

After the rights and preferences of

the outstanding shares of common stock would remain the same after the reverse

stock split. Each share of common stock issued pursuant to the reverse stock

split would be fully paid and nonassessable.

The reverse stock split would result in some stockholders owning

"odd-lots" of less than 100 shares of common stock. Brokerage commissions and

other costs of transactions in odd-lots are generally higher than the costs of

transactions in "round-lots" of even multiples of 100 shares.

The common stock is currently registered under Section 12(g) of the

Securities Exchange Act of 1934, as amended. As a result,Effective Time, the Company iswill continue to be subject to the periodic reporting and other requirements of the Securities Exchange Act.

The proposedAct of 1934. We expect that the Company’s common stock will continue to be listed on the Over-the-Counter Bulletin Board under the symbol “PAYD”, although OTCBB will add the letter “D” to the end of the trading symbol for a period of 20 trading days after the Effective Date to indicate that the reverse stock split would not affecthas occurred.

Board Discretion to Implement the registrationReverse Stock Split Amendment

If the reverse stock split is approved by the Company’s stockholders, it will be effected, if at all, only upon a determination by the Board that a reverse stock split (at a ratio determined by the Board as described above) is in the best interests of the Company and the stockholders. The Board’s determination as to whether the reverse stock split will be effected and, if so, at what ratio, will be based upon certain factors, including existing and expected marketability and liquidity of the common stock, underprevailing market conditions and the Securities Exchange Act.

Authorized Shares of Common Stock

The reverse stock split, if implemented, would not changelikely effect on the number of

authorized sharesmarket price of the Company's common stock as designated by the Company's

Certificate of Incorporation. Currently, 350,000,000 shares are authorized.

Therefore, because the number of issued and outstanding shares of common stock

would decrease, the number of shares remaining available for issuance of the

Company's common stock would increase.

Procedure for Effecting the Reverse Stock Split and Exchange of Stock

Certificatesstock. If the Company's stockholders approve the proposed amendmentBoard determines to the

Company's Certificate of Incorporation to effectmake effective the reverse stock split, the Board will consider various factors in selecting the ratio including the overall market conditions at the time and the recent trading history of Directors may elect whether orthe common stock.

Fractional Shares

Stockholders will not to declare areceive fractional post-reverse stock split shares in connection with the reverse stock splitsplit. Instead, the Company’s transfer agent for the registered stockholders will aggregate all fractional shares of common stock and arrange for them to be sold as soon as practicable after the Effective Time at any time priorthe then prevailing prices on the open market on behalf of those stockholders who would otherwise be entitled to 12 monthsreceive a fractional share. The Company expects that the transfer agent will cause the sale to be conducted in an orderly fashion at a reasonable pace and that it may take several days to sell all of the aggregated fractional shares of common stock. After completing the sale, stockholders will receive a cash payment from the date of stockholder approval. The reverse

stock split would be implemented by filing the appropriate amendmenttransfer agent in an amount equal to the Company's Certificatestockholder’s pro rata share of 6

Incorporationthe total net proceeds of these sales. No transaction costs will be assessed on the sale. However, the proceeds will be subject to certain taxes as discussed below. In addition, stockholders will not be entitled to receive interest for the period of time between the Effective Time and the date a stockholder receives payment for the cashed-out shares. The payment amount will be paid to the stockholder in the form of a check in accordance with the Delaware Secretary of State, andprocedures outlined below.

After the reverse stock split, would become effectivestockholders will have no further interests in the Company with respect to their cashed-out fractional shares. A person otherwise entitled to a fractional interest will not have any voting, dividend or other rights except to receive payment as described above.

Effect on the dateBeneficial Holders of the filing.

As of the effective date ofcommon stock (i.e. stockholders who hold in “street name”)

Upon the reverse stock split, each certificate

representingwe intend to treat shares ofheld by stockholders in “street name,” through a bank, broker or other nominee, in the Company's common stock beforesame manner as registered stockholders whose shares are registered in their names. Banks, brokers or other nominees will be instructed to make effective the reverse stock split would be deemed, for their beneficial holders holding the common stock in “street name”. However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the reverse stock split and making payment for fractional shares. If a stockholder holds shares of the common stock with a bank, broker or other nominee and has any questions in this regard, stockholders are encouraged to contact their bank, broker or other nominee.

Effect on Registered “Book-Entry” Holders of Common Stock (i.e. stockholders that are registered on the transfer agent’s books and records but do not hold stock certificates)

Certain of the Company’s registered holders of common stock may hold some or all corporate purposes, to evidenceof their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the reducedcommon stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

If a stockholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse stock split shares or cash payment in lieu of any fractional share interest, if applicable. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the stockholder’s address of record indicating the number of shares of common stock resulting fromheld following the reversereserve stock split.

All options, warrants, convertible debt instruments and other securities would

also

If a stockholder is entitled to a payment in lieu of any fractional share interest, a check will be automatically adjusted onmailed to the effective date.

The Company anticipates that its transfer agent will actstockholder’s registered address as the exchange

agent for purposes of implementing the exchange of stock certificates. As soon as practicable after the effective date,Effective Time. By signing and cashing the check, stockholders and holderswill warrant that they owned the shares of securities

convertible into the Company's common stock wouldfor which they received a cash payment. The cash payment is subject to applicable federal and state income tax and state abandoned property laws. In addition, stockholders will not be notifiedentitled to receive interest for the period of time between the effectiveness of the reverse split. Stockholders of record would receive a

letter of transmittal requesting them to surrender their stock certificates for

stock certificates reflecting the adjusted number of shares as a resultEffective Time of the reverse stock split. Persons who hold their shares in brokerage accounts or

"street name" would not be required to take any further actions to effectsplit and the exchange of their certificates. Instead, the holder of the certificate will be

contacted. However, the Company will require that each new certificate

representingdate payment is received.

Effect on Certificated Shares

Stockholders holding shares of common stock in certificate form will be sent a transmittal letter by the transfer agent after the Effective Time. The letter of transmittal will contain instructions on how a stockholder should surrender his or her certificate(s) representing shares of the Company specify and includecommon stock (“Old Certificates”), to the nametransfer agent in exchange for certificates representing the appropriate number of the beneficial ownerwhole shares of such shares.post-reverse stock split common stock (“New Certificates”). No new certificates wouldNew Certificate will be issued to a stockholder until thesuch stockholder has surrendered the stockholder's outstanding certificate(s)all Old Certificates, together with thea properly completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange agent.

Until surrender, each certificatehis, her or its Old Certificates.

Stockholders will then receive a New Certificate(s) representing shares before the reverse stock

split would continue to be valid and would represent the adjusted number of whole shares based on the one-for-six exchange ratio of the reverse stock split,

rounded down to the nearest whole share. Stockholders should not destroy any

stock certificate and should not submit any certificates until they receive a

letter of transmittal.

Fractional Shares

The Company will not issue fractional shares in connection with any

reverse stock split. Instead, any fractional share resulting from the reverse

stock split would be rounded up to the nearest whole share.

Accounting Consequences

The par value of the Company's common stock would remain unchanged at

$0.001 per share after the reverse stock split. Also, the capital account of the

Company would remain unchanged, and the Company does not anticipate that any

other accounting consequences would ariseto which they are entitled as a result of the reverse stock split. Until surrendered, the Company will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of whole shares of post-reverse stock split common stock, as applicable, to which these stockholders are entitled.

Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for new certificates. If an Old Certificate has a restrictive legend, the New Certificate will be issued with the same restrictive legends that are on the Old Certificate.

If a stockholder is entitled to a payment in lieu of any fractional share interest, such payment will be made as described above under “Fractional Shares”.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Accounting Matters